USD exchange rate today: Early morning of August 25, the State Bank announced the central exchange rate of the Vietnamese Dong to the USD remains unchanged, currently at 25,298 VND.

USD exchange rate in the world last week

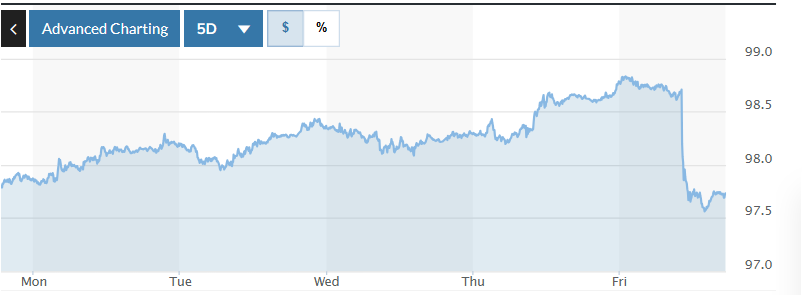

The US dollar (USD) weakened last week amid rising risk sentiment in the market. After recovering in the first half of the week, the USD lost momentum on August 23, shortly after the speech of Federal Reserve Chairman Jerome Powell at the Jackson Hole Symposium. The Fed Chairman Powell all but confirmed that the benchmark interest rate would be cut in September, the unexpected news led to strong market volatility. The US dollar index (DXY), which measures the value of the USD against a basket of six major currencies, fell to 97.73 points, erasing most of the gains and recording its third consecutive weekly loss.

Chart of DXY Index fluctuations over the past week. Photo: Marketwatch

Earlier, the USD had a moment of appreciation when the S&P Organization announced the preliminary data of the Global Purchasing Managers’ Index (PMI) for August, reaching 55.4 points, higher than the previous month’s 55.1 points. The unexpected improvement in the manufacturing sector has strengthened confidence in the resilience of the US economy, thereby reducing expectations of a rate cut in September and supporting the DXY’s increase.

In the currency market, the EUR/USD pair closed the week at a high above the 1.1700 threshold, recovering strongly from the low of 1.1583. The short-term resistance level is identified around 1.1730 points, with the possibility of moving towards the year’s peak at 1.1830 points if the uptrend is maintained. Meanwhile, the near-term support level is located in the 1.1650 – 1.1590 point area. Other central banks such as the European Central Bank (ECB) and the Bank of England (BOE) are also cutting interest rates, but the economic recovery in Europe (especially Germany with increased defense spending) has supported the EUR to strengthen against the USD.

The GBP/USD pair traded lower at times due to the impact of the greenback’s recovery when Fed Chairman Jerome Powell announced a new monetary policy direction. Accordingly, the Fed applied a flexible inflation framework, eliminating the previous inflation compensation mechanism. Chairman Powell also acknowledged the increased risks to the labor market, and said that the impact of tariffs on inflation was only temporary. These statements led to a sell-off in the USD, creating conditions for the GBP/USD pair to regain most of the week’s losses.

As for the USD/JPY pair, the exchange rate maintained a stable state, fluctuating in a narrow range around the 147.50 area throughout the past week.

The US dollar continued to weaken against many major currencies last week, reflecting the trend of capital flows shifting to riskier assets amid increasing market expectations of easing US interest rate policy.